Common Reasons of your KYC rejection on Digital Wallet

Aug. 9, 2023

KYC or Know Your Customer, is a Key to verify and identify the identity of a customer. The main objective of KYC is to ensure that financial institutions have sufficient information about their customers to understand their financial activities and assess potential risks.

The increased growth of digital transformation highlights the need for better digital identity solutions to combat any illegal activities like identity theft, money laundering, and financial fraud. Nepal Rastra Bank, the Central Bank of Nepal has made KYC verification mandatory for all customers who want to perform any sort of financial transaction.

For an effective KYC program, following three components are required:

1. Customer Identification Program (CIP)

The first step in the KYC process is to establish that the customer is who they claim to be. These steps include:

- * Name

- * Address

- * Date of birth

- * Valid documents with government authentication (Citizenship, License, Passport, Voter’s card)

Gathering relevant personal information and identity documents, verifying them, and using them to confirm the customer’s legitimate identity is a very important element in KYC verification process.

2. Customer Due Diligence (CDD)

Customer Due Diligence is all about checking and verifying a customer’s risk level. Customers Due Diligence can be separated into three tiers:

a. Basic Due Diligence (BDD): Basic Due Diligence is carried out for all customers to establish their level of risk. This can involve collecting additional information, establishing the location of the customer, and types or patterns of transactions.

b. Simplified Due Diligence (SDD): Simplified Due Diligence is a quicker model of knowing customers or identity verification. It is used when there is a low risk of money laundering, tax evasion, criminal or terrorist financing, and other financial crimes.

c. Enhanced Due Diligence (EDD): Enhanced Due Diligence is designed for high risk or high net worth customers and large transactions. Detailed analysis is done under the EDD approach for a customer thought to be at higher risk. This include obtaining and gathering more information from customers, additional checks with agencies or public sources, or detailed investigation into accounts and transactions.

Customer Due Diligence is an ongoing process which is carried out not only when onboarding a new customer. A customer’s financing activities and risk profile can change over time. So, periodic CDD monitoring should be conducted from time to time.

3. Ongoing Monitoring:

Know Your Customer (KYC) is not just about checking new customers during onboarding. Of course, it is very important to establish the identity and initial risk level of the customers but once a customer has been onboarded, keeping track of their behavior and risk status is also very important. Continuous monitoring helps to identify changes in customer activity and financial behavior that may warrant an adjustment in risk profile or further investigation.

Therefore, KYC verification is a must and is beneficial for both, organization, and the user itself. In digital wallet like Namaste Pay, users have to upload their verified documents like citizenship(both side), voter’s card, license and Passport to be a KYC verified user. But due to various factors, KYC might get rejected.

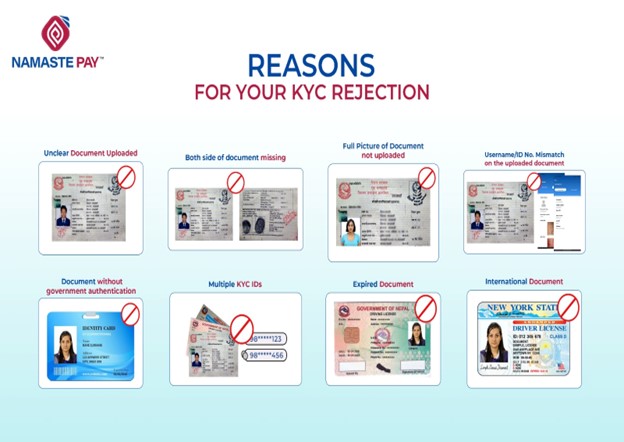

Some of the top reasons of KYC rejection while verifying on Namaste Pay for which users must be careful are:

1. Unclear document uploaded

At the time of uploading documents, users should ensure that the document they submit is clear, legible, and free from any blurriness or distortion. Otherwise, KYC get rejected due to such issues.

2. Both sides of the document missing

To complete the verification process, a complete document is required. And in the case of citizenship both the front and back sides of the document is a must. Please make sure both sides of your documents are uploaded properly.

3. Full picture of the document not uploaded

Uploading a full picture of your document is essential to verify your identity accurately. Users should make sure that the document that they have uploaded is in full picture or not.

4. Username / ID No. Mismatch on the uploaded document

The filled details should be matched with the uploaded document. To ensure accuracy, cross-check that the information on your uploaded document matches the details provided during registration process.

5. Document without government authentication

Only valid documents that are officially authenticated by the government are accepted. Users should have information regarding the valid and accepted documents before uploading to be KYC verified.

6. Multiple KYC IDs

One user should have only one KYC ID. Same user cannot get register and be KYC verified with same documents in multiple IDs. Therefore, users should open one valid account with valid documents.

7. Expired Document

Expired documents are not acceptable for KYC verification. Users have to check the validity date of their documents before uploading documents.

8. International Document

Documents which are authenticated by the Government of Nepal are only valid. International documents which are not authenticated by the Government of Nepal are not accepted. Hence KYC get rejected. Therefore, users should ensure that the document they upload is valid and accepted for KYC purposes as per the guidelines or not.

Knowing Your Customer (KYC) is essential to make sure that the onboarded customers are who they claim they are. This helps to protect everyone involved in a business relationship by shielding them from financial crime, corruption, fraud, and terrorism as well. KYC maintains the integrity of global markets and institutions and enables businesses and consumers to engage in transactions safely and securely. Failure to comply with KYC regulations indicate the lack of consumer trust. As the financial technology industry grows, organizations need to comply with these regulations.